The URS Newsroom: For Policymakers, Media, and the Public

Press Releases

March 16, 2022

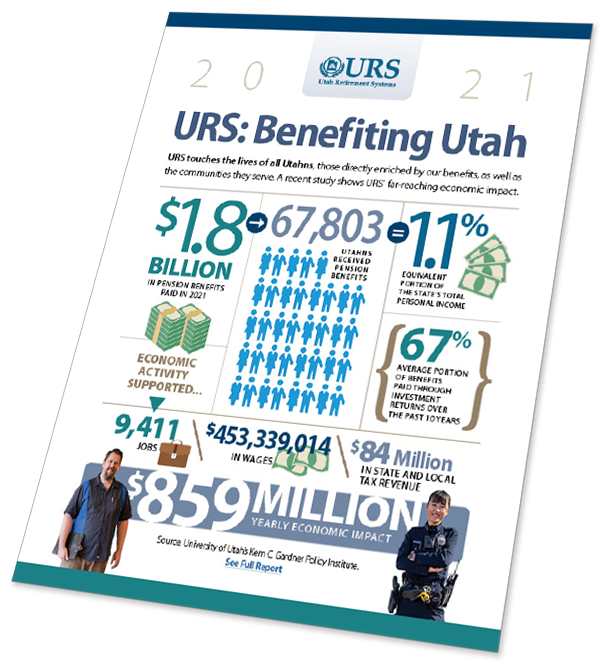

Study: URS Has Major Economic Impact on State

For Immediate Release

Utah Retirement Systems’ pension payments help keep Utah’s economy buzzing, supporting thousands of jobs and significantly boosting the tax base.

A recent study by the University of Utah’s Kem C. Gardner Policy Institute shows how these payments ripple throughout the state’s economy.

The economic activity generated by URS pension payments in 2021 supported more than 9,400 Utah jobs, $453 million in wages, and $84 million in state and local tax revenue, for an $859 million overall economic impact in Utah.

“Utah Retirement Systems supports nearly 70,000 retirees and their families through pension payments each year," said Andrea Brandley, Research Associate for the Gardner Institute. "Beyond this contribution, these dollars then circulate and multiply throughout Utah, supporting jobs, earnings, GDP, and tax revenues, playing a significant role in the Utah economy.”

In 2021, URS paid more than $1.8 billion in pension benefits to more than 67,000 Utahns, an amount so large, it’s equivalent to 1.1 percent of the state’s total personal income. For perspective, this is larger than the earnings paid by many entire industries in Utah, including motor vehicle and parts dealers, truck transportation, and repair and maintenance, according to the study.

The average portion of benefits paid through investment returns over the past 10 years is about 67 percent.

URS provides retirement and insurance benefits for Utah public employees. It serves more than 241,000 members and about 478 public employers, including the State of Utah, its local governments, school districts, higher education, and more. URS is a component unit of the State of Utah, governed by Utah Code Title 49.

Jan. 13, 2022

Study: Efficiencies Unique to Pensions Help Deliver Retirement Benefits at Half the Cost of 401(k) Accounts

For Immediate Release

A report from the National Institute on Retirement Security finds that defined benefit (DB) pension plans offer substantial cost advantages over 401(k)-style defined contribution (DC) accounts. A typical pension has a 49 percent cost advantage as compared to a typical DC account, with the cost advantages stemming from longevity risk pooling, higher investment returns, and optimally balanced investment portfolios.

The analysis also indicates that about four-fifths of the cost difference occurs during post-retirement years. Once retired, individuals typically experience substantially higher fees when retirement assets are withdrawn from a workplace retirement plan. Also, retired individuals often shift their savings to lower risk, lower return asset classes, which is further complicated by today’s historically low interest rate environment.

These findings are contained in a new research report from the NIRS, A Better Bang for the Buck 3.0: Post-Retirement Experience Drives the Pension Cost Advantage.

The analysis indicates that to achieve roughly the same target retirement benefit to replace 54 percent of final salary, a DB pension plan requires contributions equal to 16.5 percent of payroll. In contrast, an individually directed DC account requires contributions almost twice as high as the DB plan, at 32.3 percent of payroll.

Nov. 12, 2021

New EpiPen Savings Program Gives Utahns Access to Discounted Life-Saving Medication

For Immediate Release

The State of Utah, in partnership with PEHP Health & Benefits, has expanded its state-wide Insulin Savings Program to include discounted epinephrine auto injectors (aka EpiPen), which are commonly used to treat severe allergic reactions (anaphylaxis) in emergency situations.

The added program, called the EpiPen Savings Program, was approved by the Legislature under Utah House Bill 206, sponsored by Rep. Suzanne Harrison.

“This bill will allow patients to purchase this expensive and life-saving medicine for a reduced price through PEHP,” says Rep. Harrison.

The program is specifically designed to give wholesale drug pricing to those who are uninsured or have high deductibles.

PEHP Managing Director R. Chet Loftis added, “We appreciate the chance to partner with the State to help make lower cost drugs available where we can.”

To be eligible for the savings program, the following criteria must be met:

» be a resident of the State of Utah;

» be an individual who has a prescription or a standing prescription drug order for an epinephrine auto injector; and

» not be an employee or dependent of an employee of the State of Utah with epinephrine related benefits covered through PEHP Health & Benefits

To learn more about the program and see a list of discounted prices, download the program fact sheet.

The EpiPen Savings Program is in addition to the Utah Insulin Savings Program that was implemented in June 2020, which has helped over 950 Utah families afford insulin.

To sign up for either the EpiPen or Insulin savings programs and get your personal ID card, visit www.utahepipen.net and www.utahinsulin.net.

Oct. 7, 2021

Longtime URS Chief Investment Officer Retires; Replacement Named

For Immediate Release

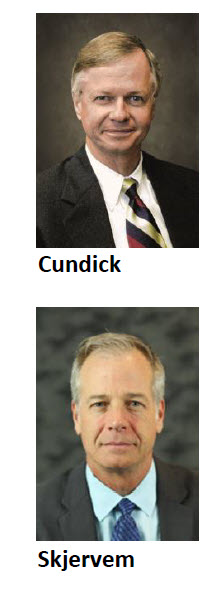

Bruce H. Cundick, recognized as one of the top Chief Investment Officers in the world, is retiring after more than 20 years at Utah Retirement Systems. Former Oregon State Treasury CIO John D. Skjervem has been named his successor, effective Nov. 8, 2021.

“I’ve been so grateful to be involved in such a world-class organization,” Cundick said. “I have a high regard for the people of URS and have developed many warm relationships. I’m especially proud of our mission. I’m happy to have been part of an organization that makes life better for other people — our members and retirees.”

Under Cundick’s watch, the URS pension fund grew from about $13 billion to about $43 billion as of June 30, 2021. In that time, the fund returned a yearly average of more than 7.8%, outperforming more than 90% of similarly sized public pension funds, according to investment consulting firm Callan and Associates.

The URS pension fund provides retirement security for Utah’s teachers, firefighters, police officers, and other public employees. During Cundick’s tenure, every dollar of benefits paid to URS retirees included, on average, about 65 cents generated through investment returns.

"URS retirees may not know his name, but Bruce Cundick played a vital role in their lives," said URS Executive Director Daniel D. Andersen. "We’ve been fortunate to have Bruce, not only for his investing expertise, but also his skill in creating and leading a world-class investment team. He’s truly a giant in his industry, and his contributions and commitment to our mission have been immeasurable."

Cundick was named one of the top 100 CIOs in the world in 2019 by Chief Investment Officer magazine, recognized for his innovation and influence, collaboration, and talent development. Under his leadership, URS receives frequent investment industry accolades for prudent fund management and innovation. URS was awarded Best Retirement Plan Design (2014) and Public Fund Investor of the Year (2009) by Institutional Investor magazine. In 2018, the American Investment Council ranked URS third among 163 U.S. public pension plans for 10-year private equity returns.

"I’m grateful for the wonderful staff that I worked with," Cundick said. "Our portfolio is a success because of their dedication and expertise. I wish them the best and am excited for them to continue to build on the accomplishments we achieved together."

After a nationwide search led by global organizational consulting firm Korn Ferry, Skjervem was selected after several qualified candidates were interviewed. From 2012-2020, Skjervem led a 60-member team responsible for Oregon’s $111 billion financial and real asset investment program, including the state’s $82 billion public employee retirement fund. More recently, he served as CEO for Alan Biller and Associates, Inc., involved in all aspects of the firm’s $131 billion investment consulting practice.

"I’m delighted and honored to join URS in an investment leadership role and look forward to extending the exemplary record Bruce and his staff have compiled during his long and distinguished tenure," Skjervem said.

Prior to his tenure in Oregon, Skjervem was an Executive Vice President at Northern Trust, where he held a variety of portfolio management and leadership positions, including Chief Investment Officer for the firm’s $180 billion wealth management division.

"We feel very fortunate to have John," Andersen said. “He brings a wealth of experience and expertise from both public pension funds as well as private sector money management. We’re confident he can help us take our investment program to the next level."

URS serves more than 240,000 current and past Utah public employees by administering their retirement benefits and managing the pension fund that pays them. URS provides financial stability for thousands of Utah families and their communities, administering benefits that help attract and retain a vibrant public workforce. It also provides a significant, reliable economic boost to the state each year. URS paid more than $1.8 billion in pension payments in 2020, the vast majority of which remained in the Utah economy.

May 15, 2020

PEHP Partners With State of Utah to Launch Insulin Savings Program

For Immediate Release

PEHP Health & Benefits is excited to announce its partnership with the State of Utah to launch a state-wide program that provides Utahns access to lower costing insulin. The new initiative, called the Utah Insulin Savings Program, was created by the Legislature under Utah House Bill 207. The bill was sponsored by Rep. Norm Thurston. The program is designed to give wholesale drug pricing to those who are uninsured or have high deductibles.

“The State recognizes the significant burden high cost insulin can be for Utah diabetics who pay out-of-pocket,” says PEHP Managing Director R. Chet Loftis. “We appreciate the chance to partner with the State to give these Utahns a lower cost option.” Participation in the program is as easy as going online to sign up.

To be eligible for the savings program the following criteria must be met:

» be a legal resident of the State of Utah;

» be an individual who has been diagnosed with diabetes;

» use insulin to treat diabetes; and

» not be an employee or dependent of an employee of the State of Utah with insulin related benefits covered through PEHP Health & Benefits

Utah residents can sign up for the program and get their personal ID card beginning June 1, 2020 at www.utahinsulin.net.

To learn more about the program and see a list of insulin discounts, download the program fact sheet.

Jan. 10, 2020

URS CIO Named Among World’s Top 100 CIOs

For Immediate Release

URS Chief Investment Officer Bruce Cundick has been named one of the top 100 CIOs in the world in 2019 by Chief Investment Officer magazine.

The magazine’s “Power 100” list recognizes CIOs from institutional investors around the globe, both public and private, based on innovation and influence, collaboration, talent development, tenure, and fund size.

“We’re fortunate to have Bruce leading our investment program not only for the expertise he brings to investing, but also his skill in creating and leading a world-class investment team way out here in Utah,” URS Executive Director Daniel D. Andersen said.

The URS pension fund regularly outperforms its peers. For example, in 2018, URS was the top-performing fund compared to similar public pension systems, according to Callan Associations Inc. database comparison of Very Large Public Pension Funds.

“I’m fortunate to work with a talented, dedicated team in the URS Investments Department,” Cundick said. “They’re the ones who have produced the results; they make all the difference.”

March 26, 2019

Study: URS Has Major Economic Impact on State

For Immediate Release

Utah Retirement Systems’ pension payments help keep Utah’s economy buzzing, supporting thousands of jobs and significantly boosting the tax base.

A study released Monday (March 25, 2019) by the University of Utah’s Kem C. Gardner Policy Institute shows how these payments ripple throughout the state’s economy.

In 2018, the economic activity generated by URS pension payments supported almost 9,000 Utah jobs, $360 million in wages, $677 million in state GDP, and $59 million in state and local tax revenue.

“Every dollar initially contributed to the system by public employers ultimately supports $1.24 of economic activity in Utah,” said John C. Downen, Senior Managing Economist at the Gardner Institute. “Beyond supporting the recipients of the payments, retiree spending of URS pension payments generated 8,800 jobs across the state with almost $360 million in earnings.”

In 2018, URS paid more than $1.5 billion in pension benefits to more than 60,000 Utahns, an amount so large, it’s equivalent to 1.1 percent of the state’s total personal income. “This is larger than the earnings paid by computer and electronics manufacturers or the arts, entertainment, and recreation industry in Utah,” Downen said.

The average portion of benefits paid through investment returns over the past 20 years is about 64 percent.

URS provides retirement and insurance benefits for Utah public employees. It serves more than 200,000 members and about 470 public employers, including the State of Utah, its local governments, school districts, higher education, and more. URS is a component unit of the State of Utah, governed by Utah Code Title 49.

______

By the Numbers

Utah Retirement Systems Economic Impact on the State in 2018

$1.5 Billion total pension payouts

60,363 total recipients

1.1% of state’s total income

8,818 jobs supported

$358,615,912 in earnings supported

$676,809,055 in regional GDP impact

$59,054,901 state and local tax impact

October 30, 2018

PEHP Health & Benefits Offers Cash Back for Using Low-Cost Healthcare Providers and Prescription Drugs

For Immediate Release

Members can earn up to $3,900/year

PEHP Health & Benefits recently launched a new cash back program aimed at helping members save money on healthcare costs. The new program, required by the Utah Legislature this year under HB 19, rewards PEHP members for using high-quality and low-cost healthcare providers. The amount of cash back can range from $50 to $2,000 for eligible services depending on the medical network. Cash back is also available for certain high-cost specialty medications.

“Healthcare costs vary based on where you go for medical services and can also vary between providers of the same type,” said PEHP Managing Director Chet Loftis. “Our cash back program is meant to encourage members to shop for medical services using our new cost comparison tool and allow them to share in the money saved.”

PEHP members can access the new Cost Comparison Tool and find cash back opportunities when they log in to their personal account. The new online tool allows members to search by medical services to find providers and costs. If cash back is available for the service, members can apply by contacting PEHP before receiving services. A PEHP Health Benefits Advisor will help them determine where to go for the best value and tell them how much cash back they can expect to receive. Members will have 90 days to get the service done.

Eligible services include:

- Colonoscopies

- MRIs and CT scans

- Various orthopedic procedures

- Some same-day surgeries

- Some inpatient stays

Cash Back for Prescription Drugs

As part of the cash back program required by HB 19, PEHP also pays members who use lower-cost chronic specialty medications available in Utah and Mexico.

“Cash back for prescriptions is available in Utah and Mexico,” said PEHP Clinical Services Director Travis Tolley. “Our pharmacy department helps members who use maintenance medications find lower-cost drug options.”

To help save money on prescriptions, PEHP also offers members the option to fill certain specialty medications at a designated accredited hospital in Tijuana, Mexico. Through the PEHP Pharmacy Tourism Program, members can fill a 90-day supply of specialty medications they’re currently taking. PEHP will coordinate travel and cover roundtrip airfare for a member and companion from Salt Lake City International Airport to San Diego International Airport, and transportation to and from the hospital in Tijuana, Mexico.

“The prescription drugs received in Mexico are the same quality and from the same manufacturer as those sold in the US,” said Tolley. “The difference is the price you pay. For example, a 90-day supply for the average cost of an eligible drug in the US is over $4,500 per month and is 40-60% less in Mexico. The substantial savings allow us to reward our members for seeking lower-cost options.”

Tolley emphasizes that the Pharmacy Tourism Program is completely voluntary. “We screen members to make sure that travel is appropriate based on their medical condition and that the 90-day supply of medication they receive will save them money to treat their chronic condition,” said Tolley.

Members who participate in the Pharmacy Tourism Program can receive $500 for each of up to four trips during the year.

“We have an obligation to those we serve to find low cost options for quality healthcare services,” said Loftis. “Pharmacy Tourism is just one such option.”

All PEHP cash back incentives are taxable income and cannot exceed $3,900 per calendar year.

May 11, 2018

Utah Public Pension Fund Grows to $32 Billion

For Immediate Release

The fund that provides retirement security to Utah’s teachers, firefighters, and police officers grew by more than $3 billion in 2017, to an all-time high of nearly $32 billion. Utah Retirement Systems, which serves more than 200,000 Utah public employees and retirees, earned a 13.6% investment rate of return.

These figures are reported in the 2017 Comprehensive Annual Financial Report, released today (Friday, May 11, 2018). The full report is available at newsroom.urs.org.

“Certainly, 2017 was a good year for the fund,” URS Executive Director Daniel D. Andersen said. “But we don’t get too enthusiastic or too discouraged by any one year. We don’t expect, nor do we need, such lofty returns each year to meet our long-term obligations. Our pension asset allocation is designed to protect Utah public employees’ benefits and minimize risk and volatility.”

The fund exceeded its assumed rate of return of 6.95%, reduced for the second straight year, from 7.2% in 2016.

“Utahns may hear of pension crises in other states,” Andersen said. “That’s far from the case here. We operate under prudent funding principals and realistic investment return expectations. Decades of careful oversight by governors, legislators, and by the Utah State Retirement Board have helped make Utah’s one of the most well-funded statewide pension plans in the nation.”

URS’ funding ratio, a key metric for measuring the health of a pension system, increased to almost 90%, from 86% in 2016. The funding ratio, in simple terms, demonstrates the fund’s proportion of assets to liabilities. A recent study estimates the average funding ratio among state-sponsored pensions nationwide to be 70.2% (2018 Wilshire Consulting Report on State Retirement Systems).

URS has a major impact in the state’s economy. URS paid more than $1.5 billion in pension payments in 2017, with more than 90% going to retirees living in Utah, including $564 million to Salt Lake County retirees alone.

URS provides retirement and insurance benefits for Utah public employees. It serves about 470 public employers, including the State of Utah, its local governments, school districts, and more. URS is a component unit of the State of Utah, governed by Utah Code Title 49.

April 11, 2016

Study: URS Has Far-Reaching Economic Impact on State

For Immediate Release

URS pension payments ripple throughout the Utah economy, supporting jobs, expanding GDP, and providing steady state and local tax revenue, a recent study shows.

In 2015, these payments supported about 8,500 Utah jobs, $350 million in wages, $650 million in GDP, and $56 million in state and local tax revenue, according to a report prepared by the University of Utah’s Kem C. Gardner Policy Institute.

“URS pension payments are not only an important source of direct income for retirees,” said Juliette Tennert, Director of Economic and Public Policy Research for the Institute. “They also support a sizeable amount of additional economic activity in Utah as retirees make local purchases that lead to increased jobs, wages, and even tax collections.”

URS paid $1.3 billion in pension benefits to 54,953 Utah residents in 2015, equivalent to about 1.1 percent of the state’s personal income. The average portion of benefits paid through investment returns over the past 20 years is 64 percent.

“Every dollar initially contributed to the system by public employers ultimately supports $1.36 of economic activity in Utah,” Tennert said.

URS provides retirement and insurance benefits for Utah public employees. It serves more than 200,000 participants and about 470 public employers, including the State of Utah, its local governments, school districts, higher education, and more. URS is a component unit of the State of Utah, governed by Utah Code Title 49.

______

By the Numbers

Utah Retirement Systems Economic Impact on the State in 2015

$1.3 Billion total pension payouts

54,953 total recipients

1.1% of state’s total income

8,514 jobs supported

$346,458,121 in earnings supported

$649,144,963 in regional GDP impact

$56,153,783 state and local tax impact

Feb. 23, 2016

URS Impact Calculated in Each Legislative District

For Immediate Release

URS has calculated its significant economic and social impact in each legislative district in Utah. These summaries break down the number of URS members and retirees in each House and Senate District as well as pension payouts in 2015.

Together, URS paid nearly $1.5 billion to retirees in Utah in 2015.

URS provides retirement and insurance benefits to almost 200,000 participants and about 470 participating employers.

See URS Impact in Each Legislative District in 2015

Feb. 1, 2016

PEHP is First in State to Achieve National Certification for Claims Efficiency

For Immediate Release

PEHP Health & Benefits has become the first entity in Utah to earn a national certification for payment and claims processing compliance.

Achieving Phase III CAQH CORE® Certification means PEHP complies not only with HIPAA, but with all the rules mandated by the Affordable Care Act (ACA).

This certification is regarded as a major achievement in the health information technology industry, PEHP Managing Director R. Chet Loftis said.

"It takes a lot of work, leadership, cooperation, and focus to accomplish a project of this magnitude,” Loftis said. “It takes everyone doing his or her part and finding solutions to the problems that inevitably come up. This is good work and we can all be proud of it."

CAQH CORE establishes national operating rules to ensure uniform, reliable, electronic data transmission, compliant with the ACA. CORE establishes national expectations for the flow and format of electronic funds transfer (EFT) and electronic remittance advice (ERA).

A division of Utah Retirement Systems, PEHP Health & Benefits is a nonprofit trust with the vital job of providing health benefits to Utah's public employees and their families.

May 21, 2015

URS Pension Fund Grows to $26.6 Billion

For Immediate Release

Utah Retirement Systems remains one of the most well-funded statewide pension plans in the nation, growing by $1.5 billion to end 2014 with total assets of $26.6 billion. These figures were reported in the 2014 Comprehensive Annual Financial Report, released Monday, May 18, 2015.

Using a diversified investment portfolio strategy, URS earned a solid 7.52% investment rate of return in 2014. URS’ strategy seeks to maximize long-term total returns consistent with prudent levels of risk.

Thanks to sound funding principals established over several decades by governors, legislators, and by the Utah State Retirement Board, URS is widely regarded as one of the most well-run public pensions in the nation.

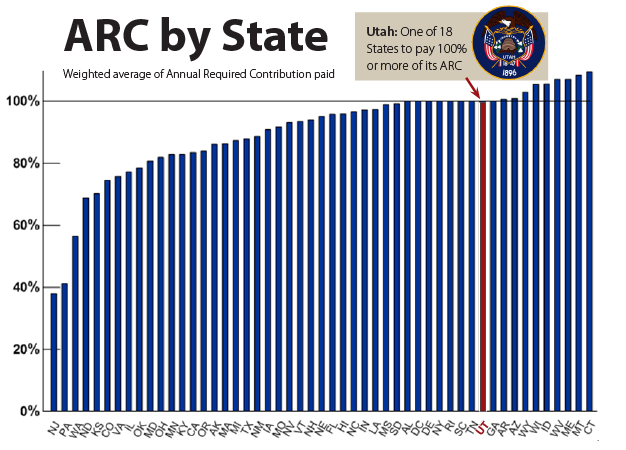

For example, a 2015 report by the National Association of State Retirement Administrators shows Utah to be one of only 18 states to pay 100% or more of its annual required contribution for 13-consectuive years. Utah’s “closely managed and well-funded pension” was recently cited as one of the main reasons the state maintains its AAA bond rating.

Assets in URS’ Defined Contribution Funds reached an all-time high of $4.5 billion in 2014.

URS serves more than 200,000 participants and about 470 public employers, including the State of Utah, its local governments, school districts, higher education, and more.

May 12, 2015

Legislative Audit Offers Positive Comments, Recommendations for URS

For Immediate Release

A legislative audit report finds Utah Retirement Systems’ management and investment practices satisfactory in most of the areas it examined and offers recommendations related to transparency and asset allocation.

The report, conducted by the Office of Legislative Auditor General (OLAG), was released May 5, 2015. It notes URS’ operating costs are “well-managed,” processes to select and retain investment advisors are satisfactory, and URS staff is well-qualified for the new investment advisory program.

It also examines the experience and background of Utah State Retirement Board members, determining they have sufficient investment experience. “The board members who represent the investment community collectively hold over 150 years of investment experience,” it states. “Furthermore, URS’ board has more investment experience compared to other peer retirement systems’ boards.”

The report notes URS administrative costs are lower than peer retirement systems. Specifically, the audit shows URS annual administrative costs were $19 lower per member than the median of peer retirement systems.

On selecting defined contribution investment advisors, the report says URS uses a, “clear process established in policy, multiple levels of complementary review and approval, and the clear acknowledgement of URS’ fiduciary duty toward members.” URS’ process for managing and retaining these advisors is “acceptable.”

The report examines URS’ transparency practices, stating, “URS has made a considerable effort to become more transparent through its website and is compliant with Senate Bill 59, passed in the 2014 General Session.” It recommends additional steps to become more transparent and improve information practices.

URS’ 7.5% assumed rate of return is described as “reasonable.” Since 2004, the 20-year average return has exceeded the assumed rate of return by an average of 0.56%. URS’ investment performance is, “about average compared to peer groups,” according to the report.

The report observes URS’ allocation of alternative investments is higher than peers and includes a recommendation from the auditor’s consultant. As the report notes, URS believes its current asset allocation is the best model to meet long-term obligations. URS is urged to review asset allocation concerns and anticipated market conditions as it makes future adjustments.

The members of the Board take their fiduciary responsibilities very seriously. The Board and its staff are committed to continually reviewing business activities and looking for ways to improve and innovate, in light of the long-term obligations of URS to its members and beneficiaries.

URS management will present the audit report to the Board and explore ways to facilitate the implementation of recommendations, consistent with URS’ purpose and fiduciary responsibilities.

“I’m proud of the great job URS does for its members,” URS Executive Director Daniel D. Andersen said. “We’re committed to always doing better, and we will use this audit as a tool to accomplish that goal.”

URS serves more than 200,000 participants and about 470 public employers, including the State of Utah, its local governments, school districts, higher education, and more.

» See URS’ Full Response to Audit

March 19, 2015

Report: Utah Among Most Well-Funded State Pensions

For Immediate Release

Many states, including Utah, are meeting their commitment to fund their public employee pension funds, according to a new report by the National Association of State Retirement Administrators.

The report, “Spotlight on The ARC Experience of State Retirement Plans, FY 01 to FY 13,” examines how state governments performed in meeting the annual required contribution (ARC) of their public employee retirement plans.

Utah was among 18 states to pay 100% or more of its ARC for the 13-year measurement period.

Even though the period of study included two economic recessions, most state and local governments increased pension contributions and maintained funding discipline to provide pension benefits for former, current, and future employees. However, the few states that conspicuously failed to fund their pension plans have a disproportionate effect on the aggregate experience. The report shows:

» All but six states paid at least 75% of their ARC

» All but two states paid at least one-half of their ARC

» The average plan received 89.3% of its ARC

Jan. 28, 2015

URS Impacts State, Local Economies

For Immediate Release

Utah Retirement Systems (URS) paid more than $1.3 billion in pension payments in 2014, the vast majority of which remained in the Utah economy.

"Having solid income is great for retirees, but it’s also advantageous for businesses and all taxpayers," URS Executive Director Daniel D. Andersen said.

Almost 93% of URS pension payouts in 2014 went to retirees living in Utah, including $485 million to Salt Lake County retirees alone.

“This is a huge economic impact,” Andersen said. “Having this reliable retirement income allows retirees to remain in their homes and support their local economies.”

Retirees in Utah and Davis counties received $180 million and $135 million, respectively. Those living in Weber, Washington, and Cache counties received $112 million, $65 million, and $48 million.

Even smaller counties felt significant impact. For example, retirees in Juab County received more than $5.6 million, and those in Rich County received more than $1.5 million.

"In some of these smaller counties, having millions of dollars poured into the local economy is pretty important," Andersen said.

An independent state agency, governed by Utah Code Title 49, URS serves more than 200,000 participants and about 470 public employers, including the State of Utah, its local governments, school districts, higher education, and more.

Breakdown of Pension Payouts by County

Jan. 15, 2015

Survey Shows Employers 99% Satisfied With PEHP

For Immediate Release

Employers’ overall satisfaction rating with PEHP was 99% in 2014, according to a third-party survey.

It revealed a level of satisfaction that was "off the charts" for our industry, according to NSON Opinion Strategy, which conducted the survey. The average satisfaction rating for health insurance carriers nationwide was 70% in 2014, according to the American Customer Satisfaction Index.

Plan options, customer service, and overall cost were cited as our greatest strengths. In 2013, our satisfaction rating among members was at 86%, according to NSON. Employer satisfaction is up from 95% in 2012.

PEHP surveys employers in even-numbered years and employees in odd-numbered years.

Dec. 4, 2014

Target Date Funds Will Help Members Simplify Savings

For Immediate Release

Utah Retirement Systems (URS) will introduce Target Date Funds in its savings plans on Jan. 1, 2015.

These funds provide a diverse investment mix that adjusts over time to maintain age-based, risk-adjusted, allocations throughout a member’s lifetime.

“We’re focused on making retirement benefits as user-friendly as possible for our members,” URS Executive Director Daniel D. Andersen said. “These new Target Date Funds are a cost-effective way to add simplicity and precision to the important task of saving for retirement.”

The 12 new funds gradually adjust throughout a member’s career and into retirement. The investment mix — which includes stocks, bonds, and alternatives such as commodities and REITs — is automatically reallocated to be weighted more conservatively as members age and approach retirement.

The underlying investments are managed by solid, well-known money managers (e.g., Blackrock, Dodge & Cox, Dimensional Fund Advisors). These new Target Date Funds will be available in the four URS Savings Plans (401(k), 457, Roth and traditional IRAs).

URS provides retirement and insurance benefits exclusively for Utah public employees, managing more than $4.5 billion in defined contribution savings plans.

“Target Date Funds are increasingly popular in the retirement industry,” Andersen said. “Instead of choosing among a number of investments and adjusting their portfolio over time, now members can select one fund that changes as they age."

An independent state agency, governed by Utah Code Title 49, URS serves more than 200,000 participants and about 470 public employers, including the State of Utah, its local governments, school districts, higher education, and more.

Aug. 1, 2014

URS Pension Sees 14.9% Annual Return

For Immediate Release

The URS pension fund returned 14.9% in 2013, exceeding its assumed investment earnings rate of 7.5%, as detailed in the 2013 Comprehensive Annual Financial Report released in May. That translated into net investment income of $3.3 billion. Total assets reached $25.1 billion at the end of 2013.

"Utah Retirement Systems' funding remains sound," URS Executive Director Daniel D. Andersen said. "Our funding as a percentage of total pension liability is 86% (as of Dec. 31, 2013), making URS one of the most well-funded state pension plans in the country."

An independent state agency, governed by Utah Code Title 49, URS serves more than 200,000 participants and about 470 public employers, including the State of Utah, its local governments, school districts, higher education, and more.

Aug. 1, 2014

URS DC Assets Reach All-Time High

For Immediate Release

The defined contribution money URS manages reached an all-time high of $4.3 billion at the end of 2013, as detailed in the 2013 Comprehensive Annual Financial Report released in May. Members contributed $276 million in 2013.

"We continue to emphasize to our members the importance of saving early and consistently for retirement," URS Executive Director Daniel D. Andersen said. "We offer a number of educational opportunities for members to learn about investing. In order to better serve members, we're creating enhanced investment guidance tools that will assist members in making critical investment decisions."

URS offers four retirement savings plans (401(k), 457, Roth and traditional IRAs).

An independent state agency, governed by Utah Code Title 49, URS serves more than 200,000 participants and about 470 public employers, including the State of Utah, its local governments, school districts, higher education, and more.

Aug. 1, 2014

Report Shows Utahns, Americans Behind in Retirement Planning

For Immediate Release

A new national analysis of retirement savings paints a dismal picture of Americans’ retirement readiness. And Utahns are in the same precariously poised boat as the rest of the country.

Utahns carried an average retirement savings plan balance of only $26,756 in 2012, according to the National Institute on Retirement Security’s State Financial Security Scorecard. That, combined with other factors, gives Utah an overall retirement readiness grade of 5, considered average.

"You hear a lot about the problems facing public pension plans," URS Executive Director Daniel D. Andersen said. "And some of them have some serious problems, while others, like ours in Utah, are doing pretty well, but still face challenges. But the bigger challenge is the overall retirement readiness of people across the country."

The report shows fewer than half of Utahns (43.39%) contribute to a private sector retirement savings plan (compared to 46% of all Americans). The average balance among all Americans is $30,345, which, according to the report, falls "significantly short of being on track towards adequate retirement income." Lack of action at the federal level leaves much responsibility to the states, the report adds.

"This is a challenge for all of us, as taxpayers, as citizens, all of us together," Andersen said. "If people, as they age, don’t have something to live on in retirement, that's a huge pressure placed on all of our social programs. To the extent any of us have influence with our neighbors, our co-workers, our family members, we should do what we can to encourage saving."

An independent state agency, governed by Utah Code Title 49, URS serves more than 200,000 participants and about 470 public employers, including the State of Utah, its local governments, school districts, higher education, and more.